Build A Tips About How To Apply For Permanent Account Number

Obtaining a pan is optional or voluntary like a passport, driving license, aadhaar etc.

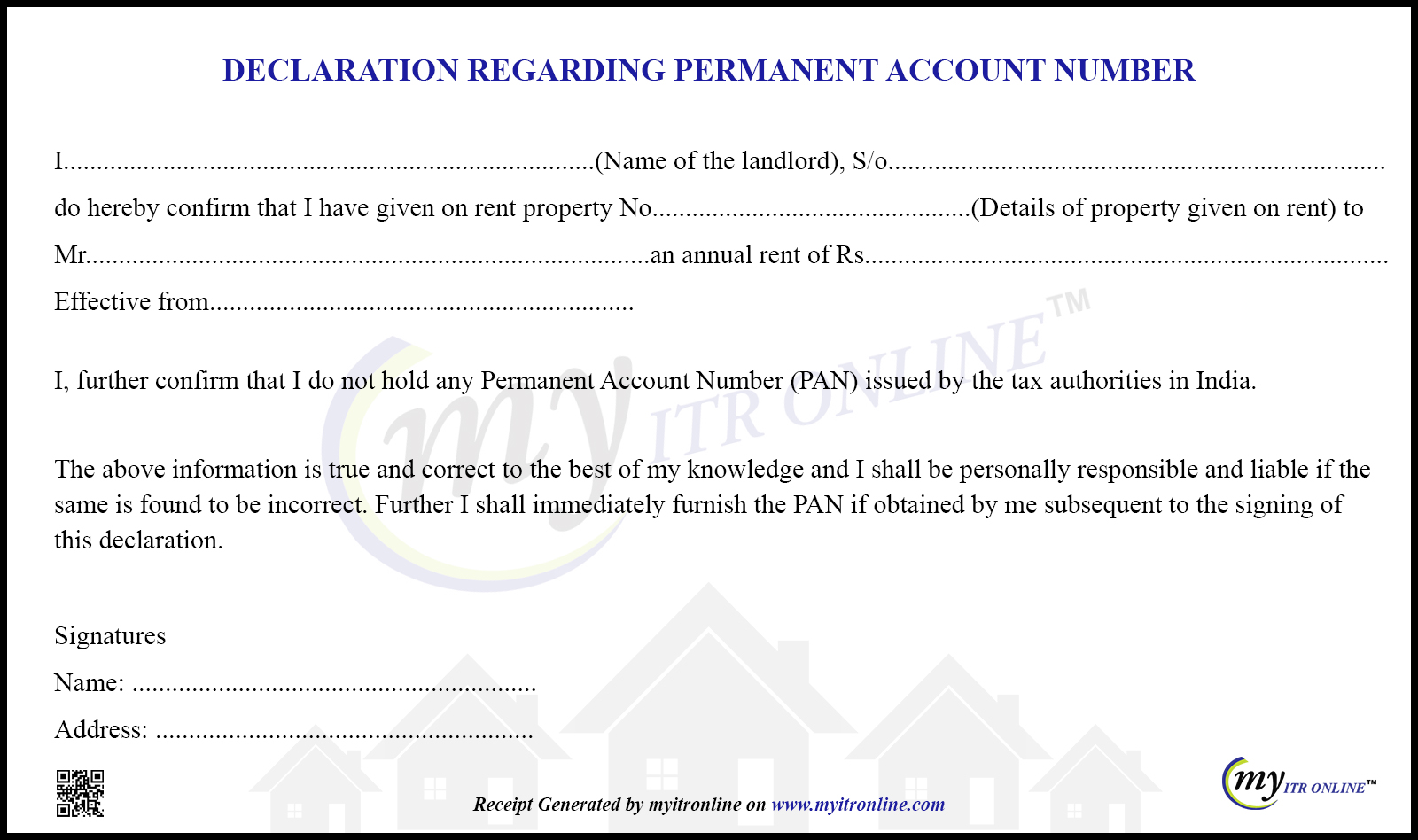

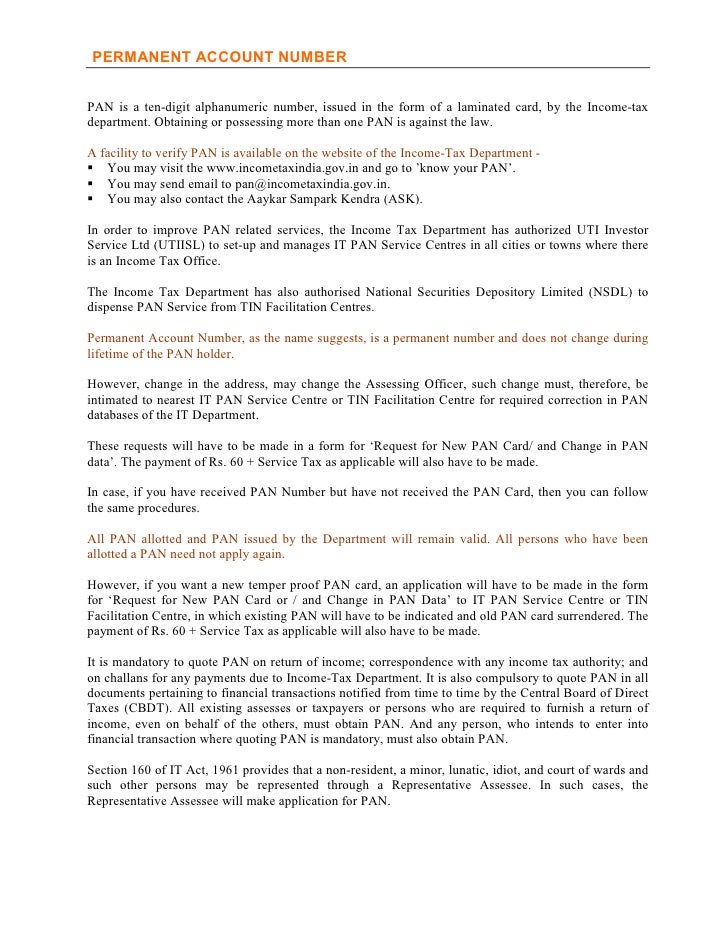

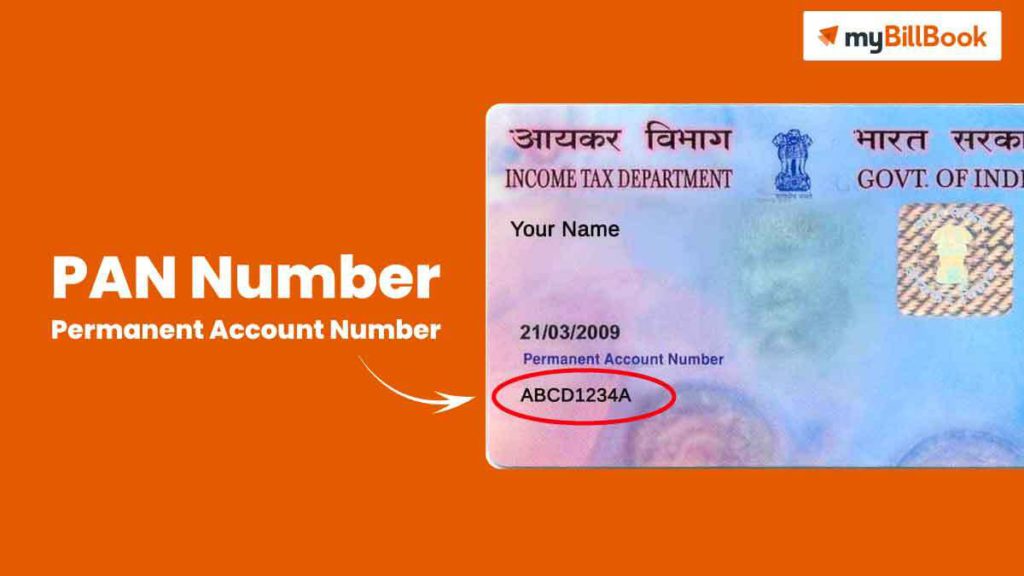

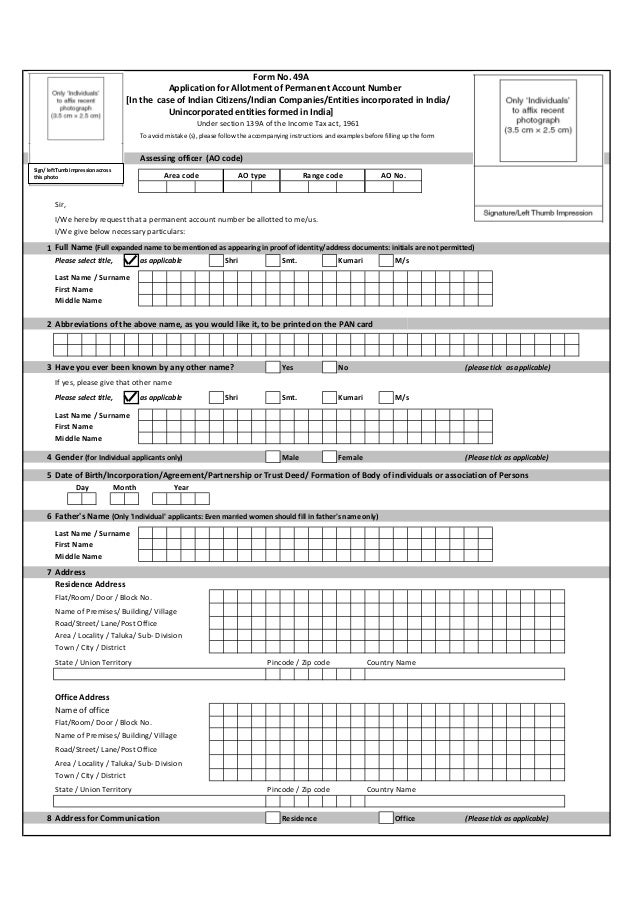

How to apply for permanent account number. It is mandatory to quote your permanent account number (pan) while filing your income tax return. Pan card online application: One can apply for pan by submitting the prescribed pan application to the authorized pan agency of the district or through online submission to nsdl, which is now rebranded as protean egov technologies limited, website, utiitsl along with 2 recent passport size color photograp…

(tangkapan layar video direktur jenderal. You can submit application by following the links authorised by income tax department: How to apply for a pan in india?

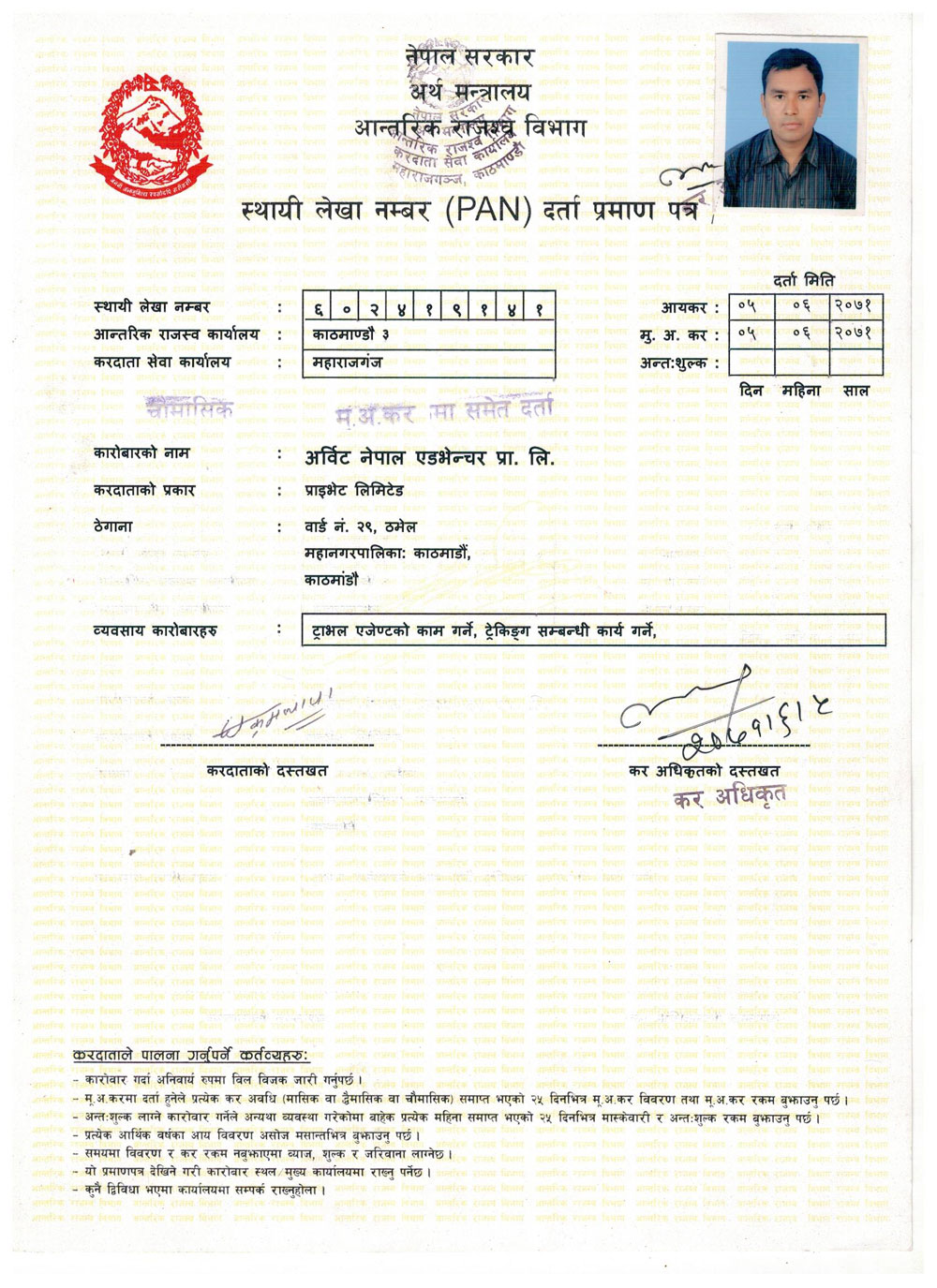

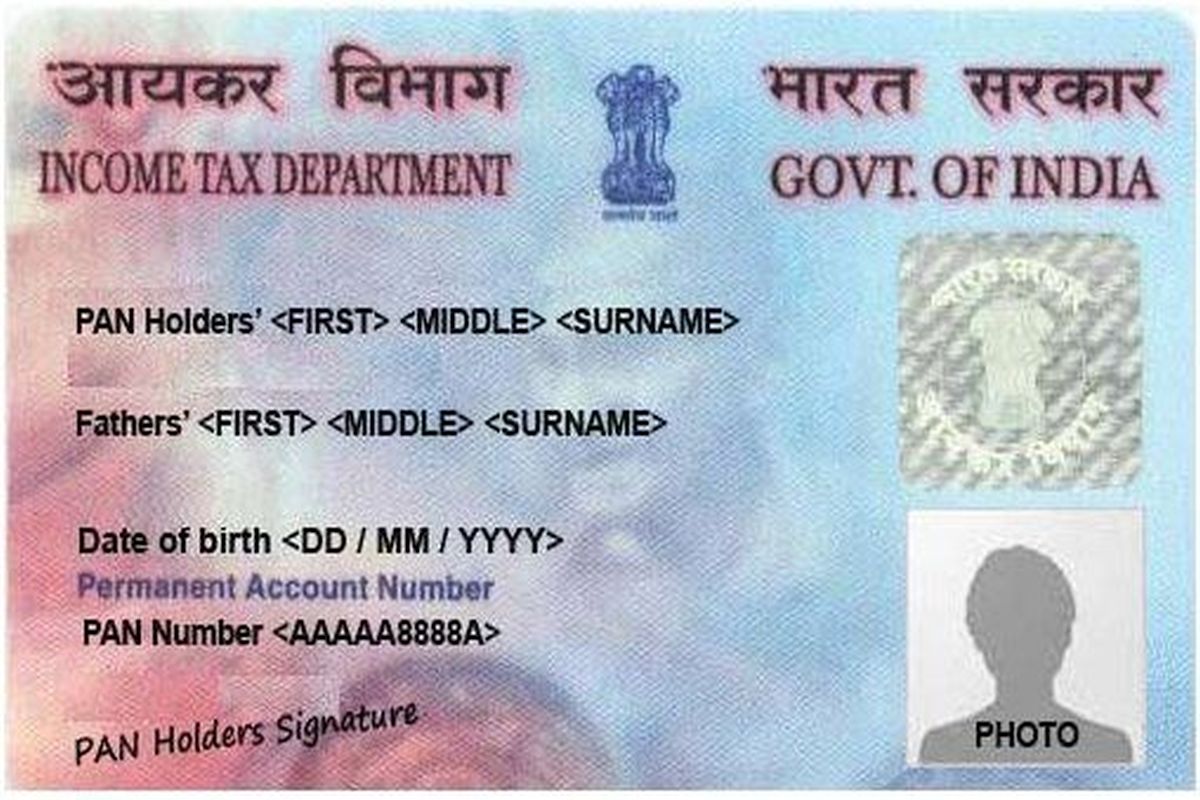

What is a pan card? A pan, short for permanent account number, is more than just a card with a number on it. To obtain a permanent account number in india, you (or your entity) will need to be liable to pay tax to the income tax department of india.

Cara mendapatkan qr code ktp digital adalah dengan mengajukan permohonan pencetakan melalui dinas kependudukan dan pencatatan sipil. In this article we will let you know. Importance of linking pan with aadhaar.

Issued by the income tax department of india, it's a core part. How to apply for pan | income tax permanent account number faq information. Apply for pan card online.

Income permanent account number (pan) faq and guidance about. Income tax department (itd) issues permanent account number or pan card. Permanent account number (pan) card, which is issued by the income tax department, enables the taxman to track all transactions of the person.

All you need to do is enter your application type and acknowledgment number. You can apply for a permanent account number in following two ways. Unduh dan isi formulir aktivasi efin pajak di bawah ini.

Kosongkan dahulu kolom efin, petugas kpp akan mengisikannya untuk. You can easily track your pan application by visiting the nsdl website. Users can apply online for the permanent account number (pan card) with the help of this online application form provided by the income tax department, ministry of.

In this article, we discuss. The pan card will be issued in 15 days after the nsdl. Submit the pan card application form 49a available on the nsdl.

_Card_11.gif)

:max_bytes(150000):strip_icc()/account-number.asp-FINAL-887f9ae4a2eb402e9d4beeaa55f29ca5.png)

_Card_02.gif)

_Card_10.gif)