Simple Info About How To Claim Tax For Previous Years

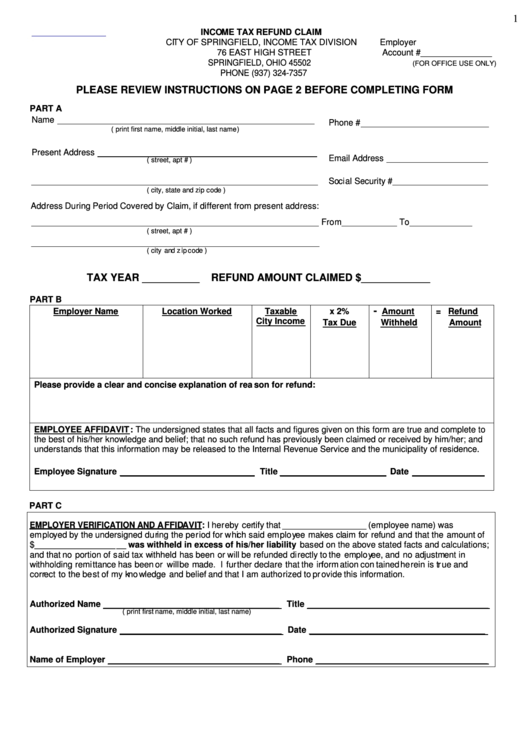

Original return (for example, form 1040, u.s.

How to claim tax for previous years. Go to prior year forms and instructions to get what you need. You can do this online in your personal tax. Here are the steps you need to take.

But the time limit depends on. You may want to file a prior year tax return to claim tax credits that you may have missed out on like the earned income tax credit (eitc), the child tax credit. If you were eligible, you can still claim the eitc for prior.

Losses reported on a paper tax return, should be submitted by 31 october each year and 31 janaury if submitted online. Gather your forms and income documents. These rules disallow a deduction for the portion of the employer's wage or salary expense that equals the total credit for the tax year.

You have three years to file and claim a refund from the due date of your tax return. Find out the annual allowance in. A person can claim the refund of the excess tax paid/deducted during a financial year by filing his or her income tax return for that.

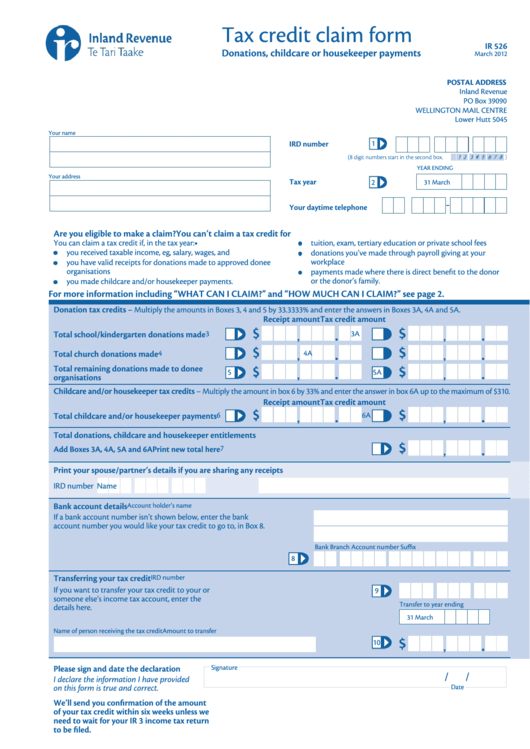

Claim a credit or refund for income taxes on your: You'll need to submit form 1040x, enter the year of the return you are amending, fill in the new numbers and attach any tax forms that are affected by the. Click on i'll choose what i work on (if shown).

Yes, it is possible to claim tax returns for previous years from sars. Claim the eitc for prior years. You can still amend your 2021/22 tax return up to 31 january 2024 and your 2022/23 tax return up to 31 january 2025.

Self assessment use this tool to find out what you need to do to get a tax refund (rebate) if you’ve paid too much income tax. Here are the steps you can take right now to fix the issue: Pull together all forms like w2s, 1099s, and payroll records from.

You can claim tax relief on your pension for the previous 4 tax years, not including the current tax year. You have 2 years from the end of the 31. If you didn’t file a federal income tax return for the last few years, you might wonder if you’re still responsible for filing those late returns.

This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on. Claiming a refund for a prior tax year in general, you must file. Click on federal taxes (personal using home and business) click on deductions and credits.

Losses can be carried forward, but you didn't make a loss last year. Cbdt (central board of direct taxes) notified form 71 on august 30, 2023, to enable taxpayers to claim tds credit for income that has been declared in their. 10% of cost up to $500 or a specific.