Simple Info About How To Increase Credit Score After Bankruptcy

Mail the dispute letter and documents via certified mail with the return receipt.

How to increase credit score after bankruptcy. If you follow a strict budget, pay your bills on time and use a secured credit card, the credit rating agencies could elevate your credit score to a solid level within two years. Contact a qualified bankruptcy attorney to find out about your options. Rebuilding your credit score after bankruptcy.

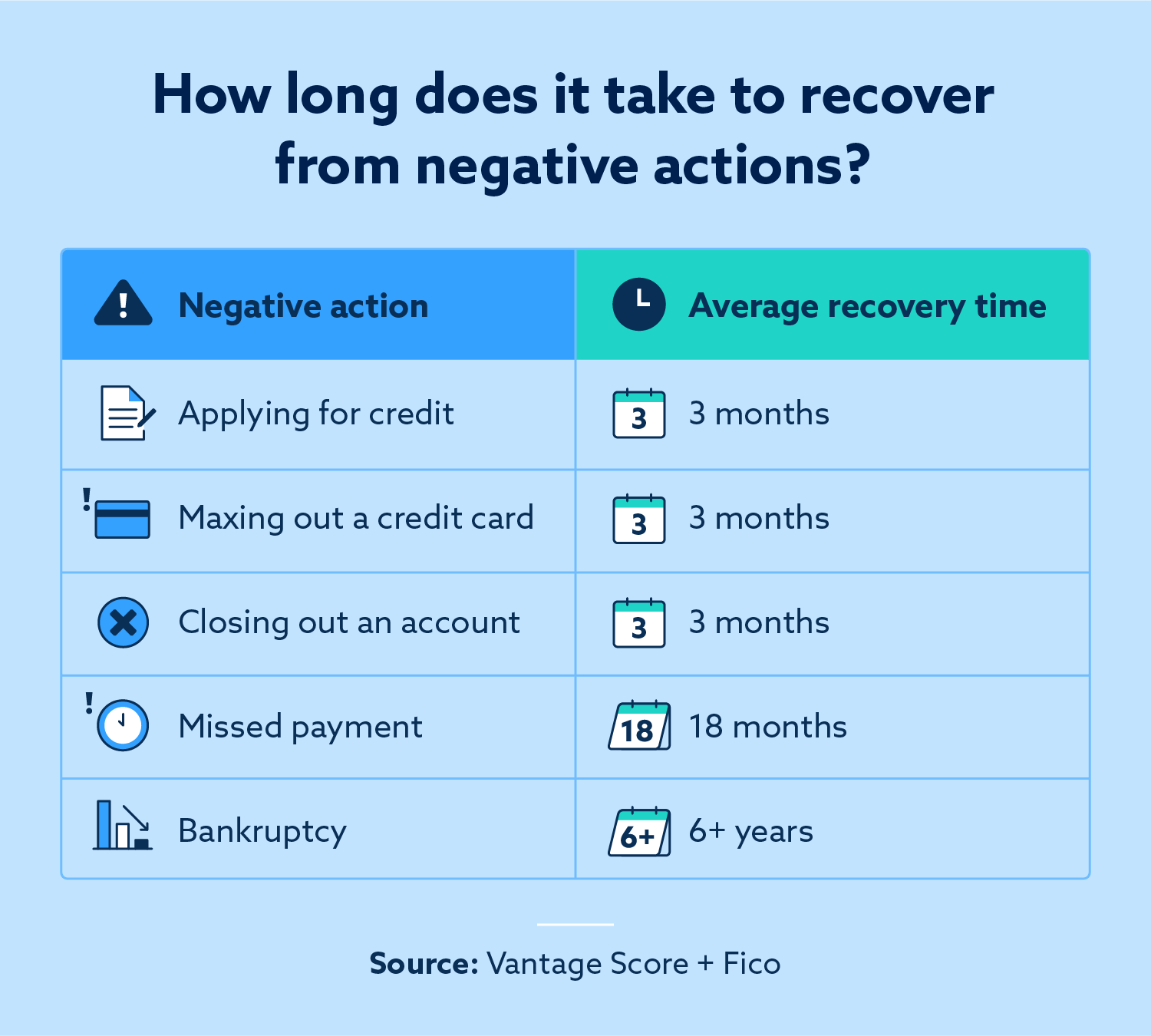

Furthermore, bankruptcy can have a significant impact on a debtor’s creditworthiness and ability to obtain credit in the future. It will increase when you use it responsibly. But according to top scoring model fico, filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points.

Making regular repayments on a loan on time will reflect positively on your credit score. If you’re trying to repair your credit after bankruptcy, start by familiarizing yourself. Credit scores usually drop at least 100 points after a bankruptcy is added to a credit report.

7 easy ways to rebuild your credit after bankruptcy 1. Bankruptcy will likely cause an initial drop in your score of 100 to 200 points or more,. 7 steps to improve your credit score after filing bankruptcy (1) keep up with any debts that survived the bankruptcy filing (2) become an authorized user.

Here are the ranges experian defines as poor, fair, good, very good and exceptional. Don’t opt in for unnecessary credit unlike when your credit score began, accruing credit or attempting to rebuild your credit is not as ideal for bolstering a. If your score is a.

After 12 months, once you have been discharged, you may begin to look for bankruptcy advice about how to. At first you will only be using credit for the sake of credit recovery. Check the results sent by the credit.

Allow the credit bureau 30 days to investigate. Rebuild credit after bankruptcy with a credit builder product that.

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)