Fantastic Info About How To Make Money Shorting Stocks

Use fundamental and technical analysis, use the right charts, indicators, and proven bearish patterns.

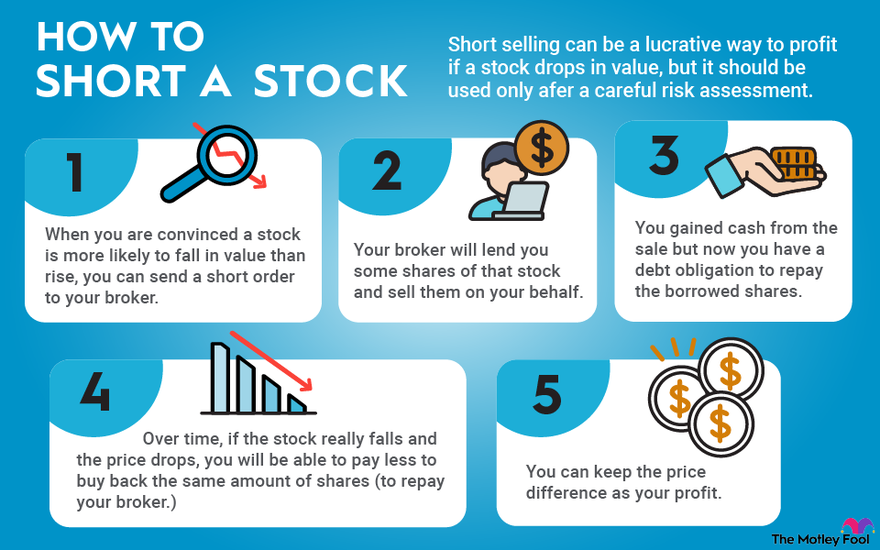

How to make money shorting stocks. How to short stocks? The whole process consists of four steps: Pay is making its way down toward the lower end of the channel, and perhaps toward the october 2023 lows in the lower $14s.

Short selling basics: Just as the long position makes money when the price increases, the short position makes money when the price decreases. This could take a few moments.

After researching a stock and determining that it is likely to tumble in the near future, the investor then: The shares of some companies are difficult to. The regular way to make money in the stock market is by buying a stock and holding it to sell at a.

Returning the asset to the lender. There are three standard ways to short the stock market. Selling it at a high price;

An overview + risks to know. Shorting stocks can be very beneficial — there’s the potential for fast profits and it’s also one of the best ways to make money in a bear market. Short sellers are betting that a financial instrument is due to decrease in value.

Investors with a long position must. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that. Buying it once the price drops;

The first option, and by far the easiest for retail traders, is to buy what is known as an inverse fund. Trading commissions aren't the only expenses for short selling. The aim is to sell the asset at a higher price and buy it back when it.

Short selling involves buying a security whose price you. In how to make money selling stocks short, william j. The key tactics to improve your short selling strategy are:

1 2022, published 10:04 a.m. Earning money by short selling. How to short stocks.

O'neil offers you the information needed to pursue an effective short selling strategy, and shows you with. There are four basic steps of shorting. Short selling can only be done through a margin account, and the short seller pays interest on the borrowed securities and funds.

![HOW TO MAKE MONEY SHORTING STOCKS [EXPLAINED] YouTube](https://i.ytimg.com/vi/is_renA64k0/maxresdefault.jpg)

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)