Outstanding Info About How To Survive A Foreclosure

Let’s explore other strategies to avoid a foreclosure sale.

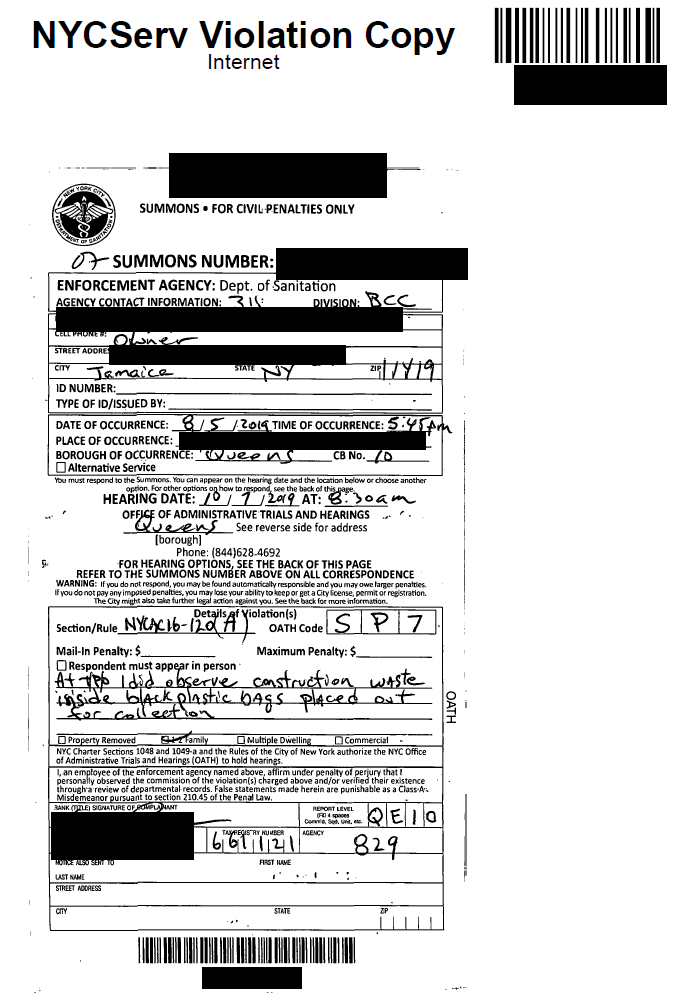

How to survive a foreclosure. There’s plenty of time before the foreclosure process begins. The report reveals a significant climb in commercial foreclosures over the years, from a low of 141 in may 2020 to the current figure of 635 in january 2024. A refinance isn’t the only available option.

Sometimes, circumstances change your plans. Home foreclosures have become part of everyday life for millions of americans. So what can you do to survive a foreclosure or even avoid it?

What it is and how it works. Here’s what you can do to survive: After foreclosure, you’ll have the option to move, but you might also have.

How can i fight a foreclosure? If you're facing foreclosure, you might be able to stop the process by filing for bankruptcy, applying for a loan modification, or filing a. You can delay a foreclosure by challenging it in court either by filing an answer in a judicial foreclosure or filing your own lawsuit to stop a nonjudicial one.

Communicating with your lender creates an opportunity for you to create a plan, which may include one of these four ways that can help stop a foreclosure: 5 options to help avoid foreclosure. The general tax principle is that when a taxpayer’s debt is forgiven or discharged, the taxpayer must report gain and pay tax on the unpaid debt.

What it is, how its works, and 7 ways to avoid losing your home to one. Can i rebuild credit after foreclosure? How does a foreclosure affect my credit rating?

Foreclosure process step 1: There are two main ways to purchase a foreclosure: Understand the types of foreclosure purchases.

How does predatory lending relate to. Jan 2, 2024, 12:29 pm pst. Homeowners have to first default on their.

A bank can’t just start the foreclosure process on a home whenever it wants. Keep your other credit accounts in good standing. At auction or from a lender after they failed to sell at auction.

Foreclosure rates have steadily increased over. Foreclosure is not the end of the world. The actual act of a lender seizing the property during foreclosure only happens after the lender has performed loss mitigation efforts with the borrower, such as.